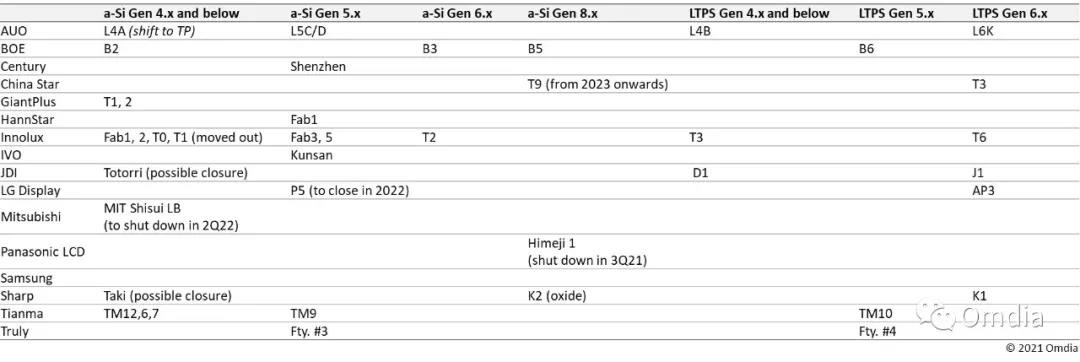

On-board display panel production is shifting to the A-SI 5.X and LTPS 6 generation lines. BOE, Sharp, Panasonic LCD (to be closed in 2022) and CSOT will produce at the 8.X generation plant in the future.

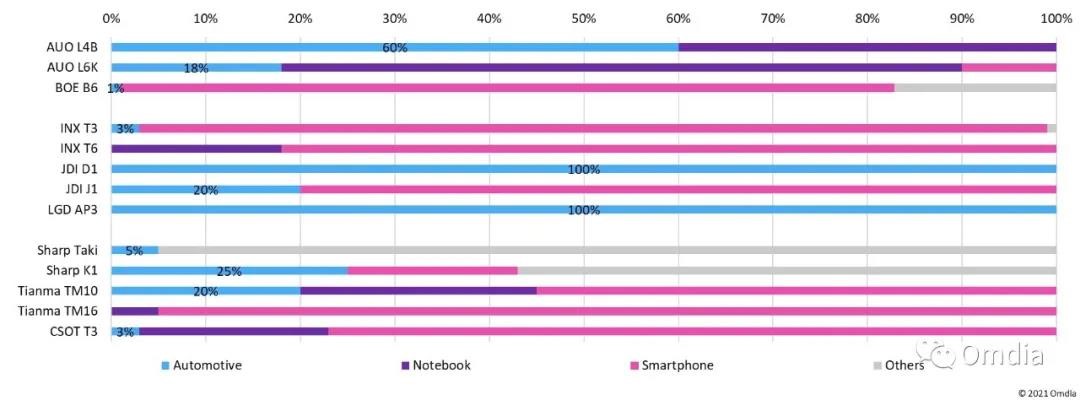

On-board display panels and laptop display panels are replacing smartphone panels, and have become the main application of LTPS LCD production line.

JDI, Sharp, LG Display and AU Optronics have quickly shifted their business focus to the LTPS in-cell touch market, while BOE, Innolux and Tianma started their in-cell touch business from A-SI due to their large a-SI capacity.

Plant consolidation and transfer to Daisei plant

The production of on-board display panels is being gradually consolidated and transferred to Daesei factories. Since the output is small but the variety is many, the car display panel used to be produced in 3. X /4. X generation factory. However, in recent years, the small generation plants have become too old to meet the demand of improved performance and falling prices, so these plants will be gradually closed. In addition, demand for larger screens and rapid price cuts are forcing suppliers to rethink their capacity allocation strategies. As a result, most panel suppliers have shifted a-SI production to fifth-generation factories, and even BOE, Sharp and CSOT (in future) are producing in 8.X factories. Besides, since 2020, a number of panel suppliers have been producing on-board panels at their LTPS plants on line six.

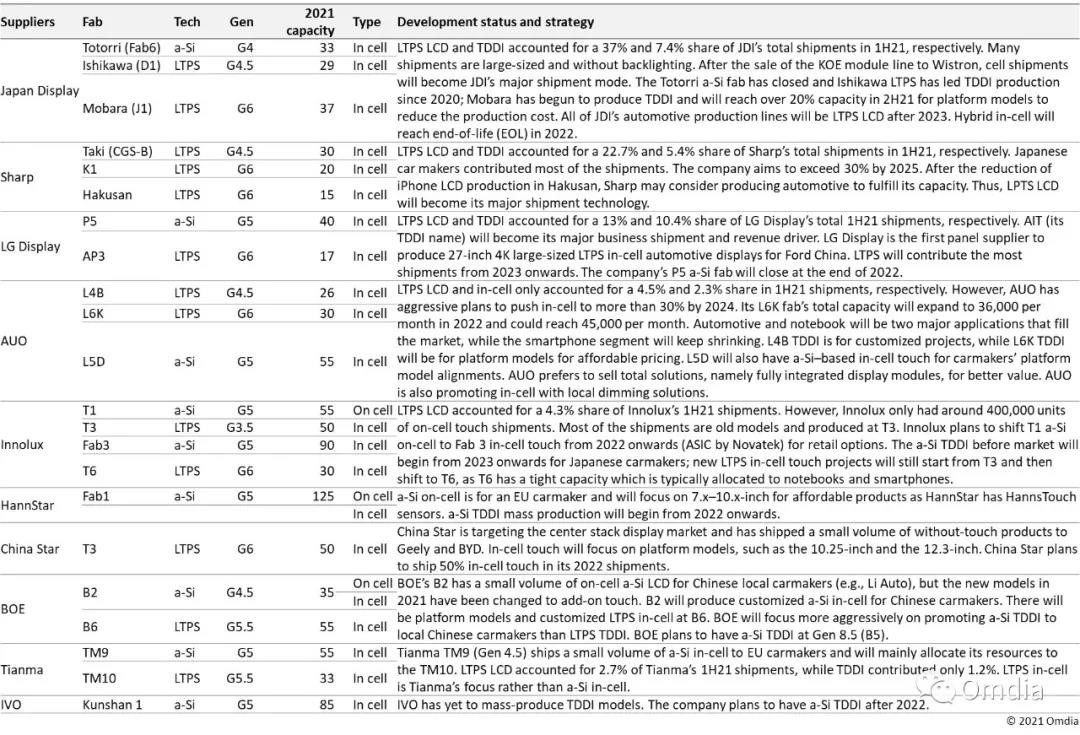

Figure 1: Overview of PANEL manufacturers’ TFT LCD vehicle Production lines, second half of 2021

The LTPS production line has an increasing proportion of on-board display panels

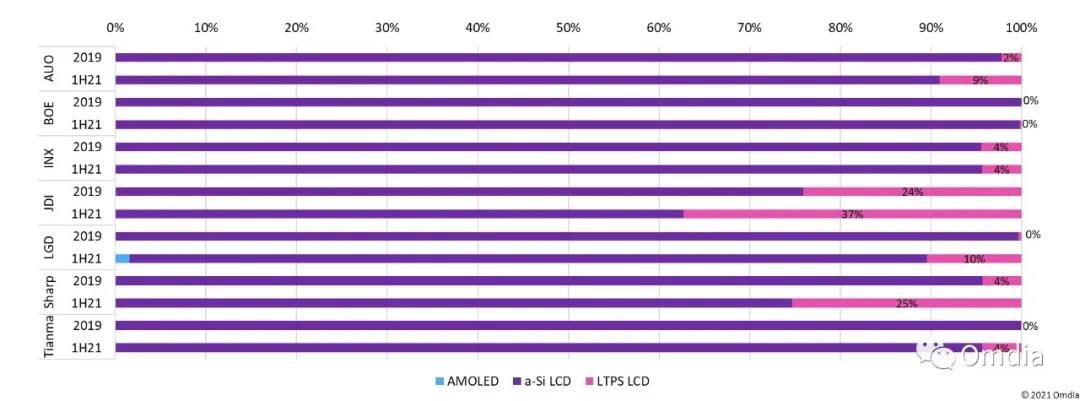

The reallocation of factory capacity also means a shift in technology. Figure 2 below shows panel vendors’ share of shipments by technology category. LTPS LCD saw significant growth in the first half of 2021. JDI and Sharp have the highest share of LTPS shipments, the main reason is capacity. Neither company has a fifth-generation A-SI plant, only a 4.5-generation and a 6-generation LTPS line. As a result, JDI and Sharp have been promoting LTPS LCDS since 2016.

Figure 2: First-tier panel vendors’ share of shipments by technology category, 2019 vs. 2021 first half year

According to the LTPS LCD plant allocation plan of front-line panel manufacturers, vehicle-mounted and notebook will replace smartphone as the main application market for LTPS LCD production in their LTPS production line. BOE, Tianma and Innolux are the only companies that still have a high smartphone share. In Figure 3, JDI D1 and LG Display AP3 have only in-car applications because they have reduced their smartphone business. Omdia anticipates that on-board display panels will soon become a major application in LTPS production lines.

Figure 3. LTPS LCD production line production allocation by application in the second half of 2021

LTPS LCD also supports the growth of in-cell touch

LTPS also accelerate the shipments of the in-cell touch displays. In addition to changes in the allocation of factory capacity, another reason for the increase in LTPS LCD shipments is the increased demand for large-size touch integration. Compared with out-of-cell touch, in-cell touch has a relative cost advantage in large size. In addition, LTPS LCDS require fewer driver ics than A-SI LCDS, resulting in the rapid growth of LTPS in-cell touch controls. Figure 4 summarizes the evolution and strategies of panel vendors.

Figure 4: In-cell trackpad development status and strategy of front-line suppliers

Post time: Dec-07-2021