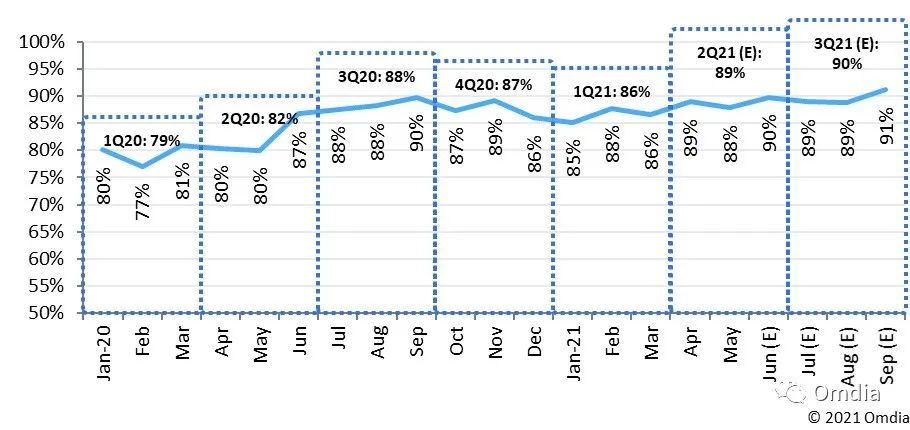

The latest report of Omdia says, despite the downward trend in panel demand due to COVID-19, panel manufacturers plan to maintain high plant utilization in the third quarter of this year to prevent higher manufacturing costs and a decline in market share, but they will face two big variables of glass substrate supply, panel price changes.

The report said panel manufacturers expect the likelihood of a decline in panel demand in the third quarter of this year to be limited and plan to maintain plant utilization at 90 per cent, up 1 percent year-on-year and quarter-on-quarter. Until the second quarter of this year, panel factories had maintained high utilization rates above 85% for four consecutive quarters.

Image: Overall capacity utilization of panel plants worldwide

However, Omdia noted that since the middle of the second quarter of 2021, panel demand in the end market and panel manufacturers’ factory capacity utilization have shown negative signs. Although panel factories plan to maintain high capacity utilization, glass substrate supply and panel price changes will be a major variable.

In May 2021, TV demand in North America fell to levels close to those seen before the 2019 pandemic, according to Omdia. In addition, TV sales in China after the 618 promotion were lower than expected, down 20 percent year on year.

Glass substrate supplying may not be kept the step. Abnormal weather conditions in early July affected the production efficiency of glass substrate production furnaces, and some glass substrate manufacturers have not fully recovered from the accidents since the beginning of the year, resulting in a shortage of LCD glass substrates in the third quarter of 2021, especially generation 8.5 and 8.6. As a result, panel plants will likely face glass substrate supply failing to keep up with planned capacity utilization.

Panel prices are expected to fall. The high capacity utilization of panel plants is expected to put pressure on TV Open cell panel prices, which will start to decline in August. Under the different strategies of panel factories to choose high capacity growth rate or avoid rapid price decline, the production capacity growth plan of panel factories in the third quarter may change.

Post time: Jul-30-2021